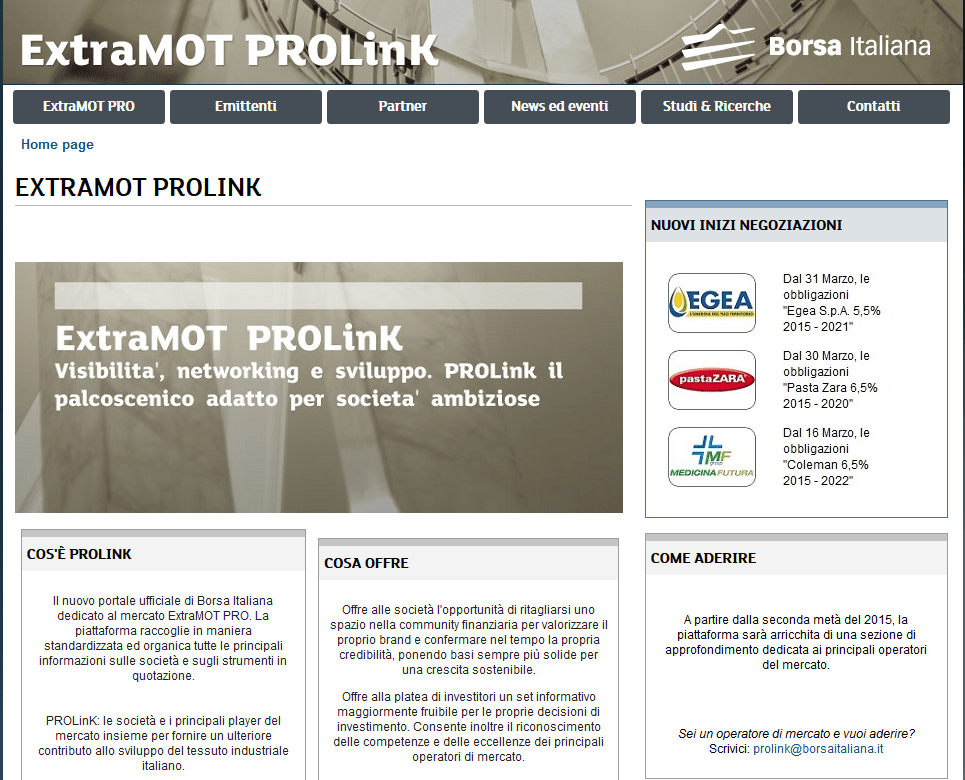

ExtraMot Pro, the professional segment of Borsa Italiana‘s ExtraMot market dedicated to listing of bonds, commercial paper, project bond and reserved to professional investors, is celebrating its second birthday with the launch of a new web portal named ExtraMot ProLink, collecting all infos about issuers and listed instruments (see here .che raccoglie in maniera standardizzata le principali informazioni sulle società e sugli strumenti in quotazione (see here the press release).

ExtraMot Pro, the professional segment of Borsa Italiana‘s ExtraMot market dedicated to listing of bonds, commercial paper, project bond and reserved to professional investors, is celebrating its second birthday with the launch of a new web portal named ExtraMot ProLink, collecting all infos about issuers and listed instruments (see here .che raccoglie in maniera standardizzata le principali informazioni sulle società e sugli strumenti in quotazione (see here the press release).

“Launched in February 2013, ExtraMot Pro has reached the figure of 100 listed debt instruments (click here for a complete list), which is a very good starting point for keeping on growing”, Pietro Poletto, head of debt capital markets at Borsa Italiana, said.

Issuers companies with debt instruments listed at the ExtraMot Pro are 86 at the moment for a total of 5 billion euros of bonds issued. of this figure a big slice comes from rather big not-listed companies with issues over 100 million euros each (i.e. Cerved, Teamsystem, Sisal, Gamenet, Cogemat, Rhiag, Marcolin, Manutencoop or Farmafactoring). On the other hand there is a growing number of not-listed SMEs issuing so-called minibonds that are small size bonds in a range averaging between 5 to 15 million euros (for a complete picture of the market, see here the Report by the Milan Politecnico University).

Actually ExtraMot Pro was born to offer to corporate and, in particular to SMEs, a national market flexible, and cost effective in which to take opportunities and tax benefits arising from the new regulatory framework of the so-called Development Decree (or Decreto Sviluppo, Decree-Law No. 83/2012, click here for the text of the Decree in italian).

The regulatory infrastructure of the new segment provides corporates with a first access to capital markets easily and efficient. The only listing requirements are publishing the annual financial statements for the past two years, the last of which audited and providing an admission document in Italian or in English with some essential information.

It isn’t required a listing prospectus in accordance with the Prospectus Directive. After the admission to listing is required to publish audited financial statements, the disclosure of the rating if a public rating is assigned, the information concerning any changes in the bond holders’ rights, and any technical information related to the characteristics of the instruments (e.g. payment dates, interest coupons, sinking schedule).