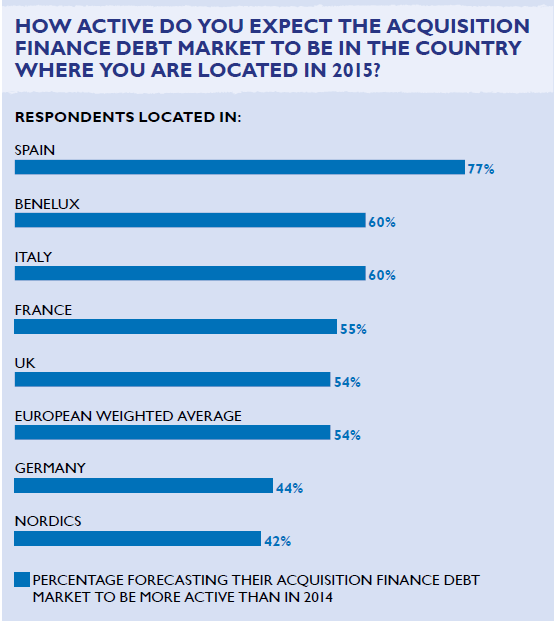

Acquisition finance actity in Italy is set to grow quite high this year. This is the answer of the majority (60%) of Italian respondents to a survey by DLA Piper law firm in collaboration with The Lawyer Research Service completed by over 300 debt providers, advisors, sponsors and corporates across Europe (download qui il report).

Acquisition finance actity in Italy is set to grow quite high this year. This is the answer of the majority (60%) of Italian respondents to a survey by DLA Piper law firm in collaboration with The Lawyer Research Service completed by over 300 debt providers, advisors, sponsors and corporates across Europe (download qui il report).

This is quite a major result if you think that Italy is second to Spain only on the issue. Over three quarters (77%) of Spanish survey respondents actually expect deal activity to increase in Spain in 2015, while only 44% and 42% of German and Nordic respondents expect deal activity to increase in their respective countries. On the whole 94% of our survey respondents expect 2015 to be either more active than last year or at least similar in activity to 2014.

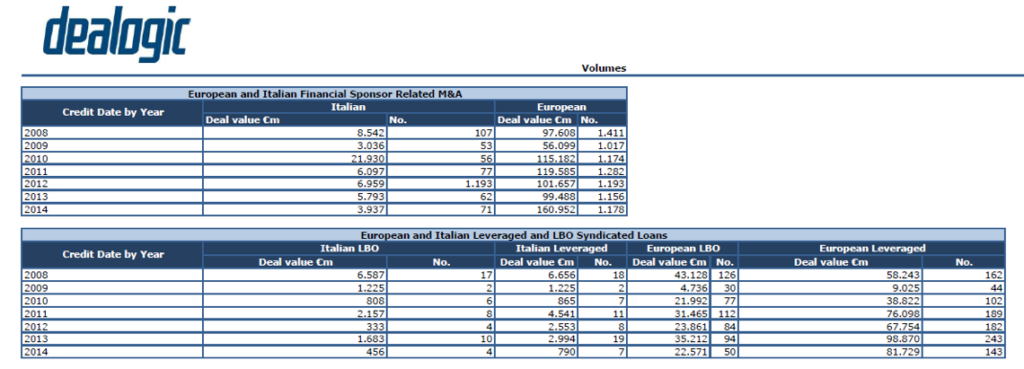

Deal activity growth was flat in Italy in 2014: some 22 deals valued at 12.1 billion euros were executed in 2014, in line with the 21 deals that were completed in 2013 as for Dealogic.

However it’s reasonable to expect a recover in acquisition finance activity in the country due to the fact that in line with most other European countries, banking liquidity has improved significantly in Italy in the past three years to the extent that banks are now ready and prepared to lend again.

In addition, Italy has introduced new legislation (see here a previous post buy BeBeez) that opens up the acquisition finance market to alternative and international lenders, effectively aligning the country with most other major European countries. The legislation is in place although a small number of implementation regulations still need to be enacted.

until the end of 2015.

Moreover, if you look just at leveraged loans and Lbo loans, year 2014 saw a big slow in activy as Dealogic recorded 4 lev loans deal for about 456 million euros only (from 10 deals and 1,683 millions in 2013) and 7 Lbo related deals for about 790 millions (from 19 deals and 2,994 millions in 2013). These figures has been elaborated by Dealogic for BeBeez (see here all the lev loans figures about Italy by Dealogic).

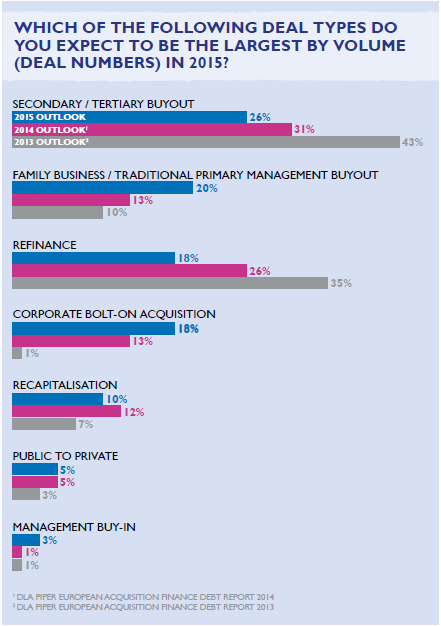

As for the kind of deals, an uptick in deal activity in 2015 will be driven by an increase in buyout activity. Survey respondents predict secondary and tertiary buyouts to be the most common type of transaction in Europe in 2015. More interestingly, for the first time in the past three years, survey respondents predict more traditional primary management buyouts in 2015 than refinancing transactions.

This is a trend that was seen in 2014 already. Some 192 loans were executed in 2014 to fund corporate

acquisitions and primary and secondary buyouts, a 4% increase on the 184 deals structured in 2013. In contrast, the number of transactions involving the refinancing of acquisition debt decreased significantly in 2014: 50 such deals valued at 29 billion euros were executed in Europe in 2014, a 28% decrease in value on the 65 deals totalling 40 billion euros in 2013. This is due to the large number of leveraged buyouts structured in 2006 and 2008 with five to seven year debt terms that have already been refinanced.

Finally 2014 was also notable for another increase in the volume of bonds used to finance acquisitions and refinance acquisition debt. Some 55 acquisition related bonds valued at 50 billion euros were

issued in 2014, a 150% increase in value on the 48 bonds totalling 20 billions issued in 2013.

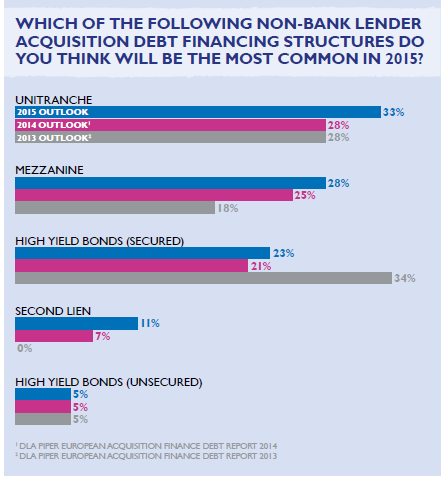

A prominent theme of last year’s report was an expectation that private debt funds and alternative lenders would start to dominate the acquisition finance debt market. The intensification of competition between alternative lenders and banks resulted in a wide array of funding products being offered to borrowers in the mid-market, including senioronly structures, term loan B tranches, mezzanine, unitranche, second lien and various combinations of these products.

As for 2015 survey respondents expect unitranche structures, which combine senior and subordinated debt into one debt instrument at a blended price, to be the most common non-bank acquisition debt finance structure.

Greater competition in the market has resulted in a reduction on loan margins and arrangement fees. The majority (54%) of banks and alternative lender survey respondents plan to increase their acquisition finance lending targets in 2015 and new lending funds are coming to the market which will put pressure on loan pricing and margins in 2015. Over 80% of respondents expect the typical senior term loan A margin to be below 4% in 2015, a marked increase on the 60% expecting sub-4% margins in last year’s survey, and 11 % in 2013.

Pressure on arrangement fees also looks set to intensify in 2015: the majority (73%) of respondents expect the typical senior dent arrangement fee to be below 3.75% in 2015, a significant increase on the 50% predicting sub-3.75% fees last year.