Andrea Bonomi raised another time its bid on Club Med‘s share and offered a price of 24 euro per share last Friday December 5th through Global Resorts (the investment vehicle controlled by Bonomi’s Investindustrial and partecipated by Kkr, Sol Ketzner, GP Investments and PortAventura‘s management).

Andrea Bonomi raised another time its bid on Club Med‘s share and offered a price of 24 euro per share last Friday December 5th through Global Resorts (the investment vehicle controlled by Bonomi’s Investindustrial and partecipated by Kkr, Sol Ketzner, GP Investments and PortAventura‘s management).

That price was the minimum price allowed by French Supervisory Authority of Financial Markets (AMF) for a competitor to launch a counter-bid when a previous bid is on track. Actually Chinese conglomerate Fosun‘s offer (through Gallion Invest II) was raised last December 1st at 23.50 euro per share (see a previous post by BeBeez).

Bonomi had now until 1700 GMT on Dec. 17 to make a counter-offer but he moved before. AMF fixed a new deadline for Fosun to make its counter-offer in turn on Dec. 19 (download here the AMF’s statement).

After Fosun had made its counter-bid, Club Med’s board said it was worried about the consequences that a potential new counter-bid might have on Club Med’s accounts as bidders would aim at a return from their investment”. Actually Club Med’s chairman and ceo Henri Giscard d’Estaing, who is personally involved in FOsun’s bid together with other top managers of the company, said to the international press that he thoght that if Bonomi had won the race he would have just adopted a cost-cutting approach inorder to obtain a return on its investment.

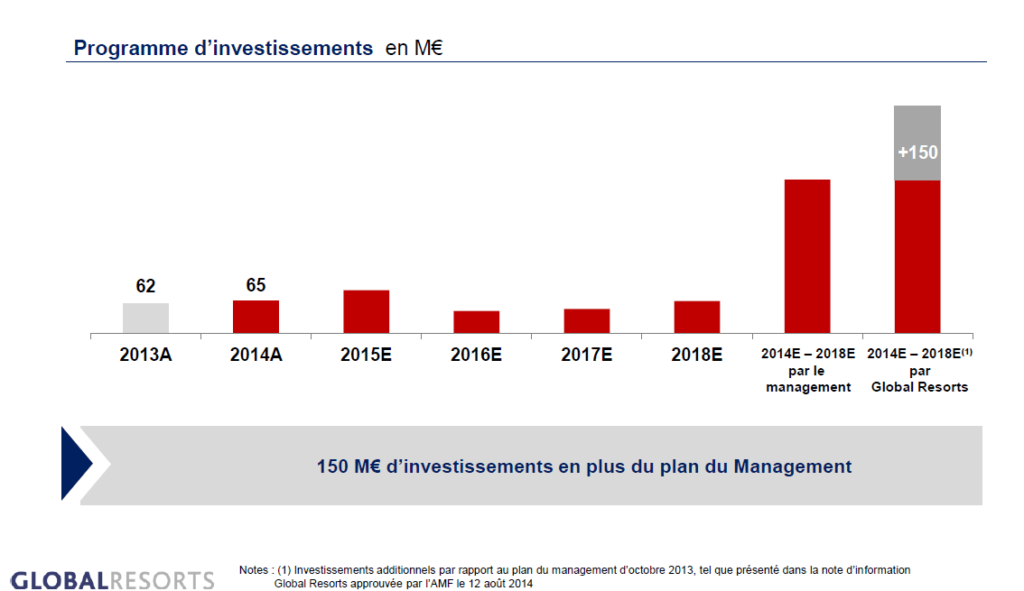

Bonomi answered the challange holding a press conference last Friday Dec 5 in order to explaing its strategy for Club Med. More in detail Bonomi said that Investindustrial’s project consists in investing in the company 150 million euros more than the figure included in the 2014-2018 business plan prepared by the management and that the focus of the company grow will be Europe, Asia and America, accelerating opening of 4 and 5 trident villages, still keeping interest on 3 trident villages in order to mantain an accessible offer (download here Bonomi’s investoes presentation).