Chinese conglomerate Fosun International led by billionaire Guo Guangchang raised its bid for Club Mediterranée yesterday at the last minute, outbidding the offer by Italian tycoon Andrea Bonomi‘s private equity fund Investindustrial (download here Fosun’s press release).

Chinese conglomerate Fosun International led by billionaire Guo Guangchang raised its bid for Club Mediterranée yesterday at the last minute, outbidding the offer by Italian tycoon Andrea Bonomi‘s private equity fund Investindustrial (download here Fosun’s press release).

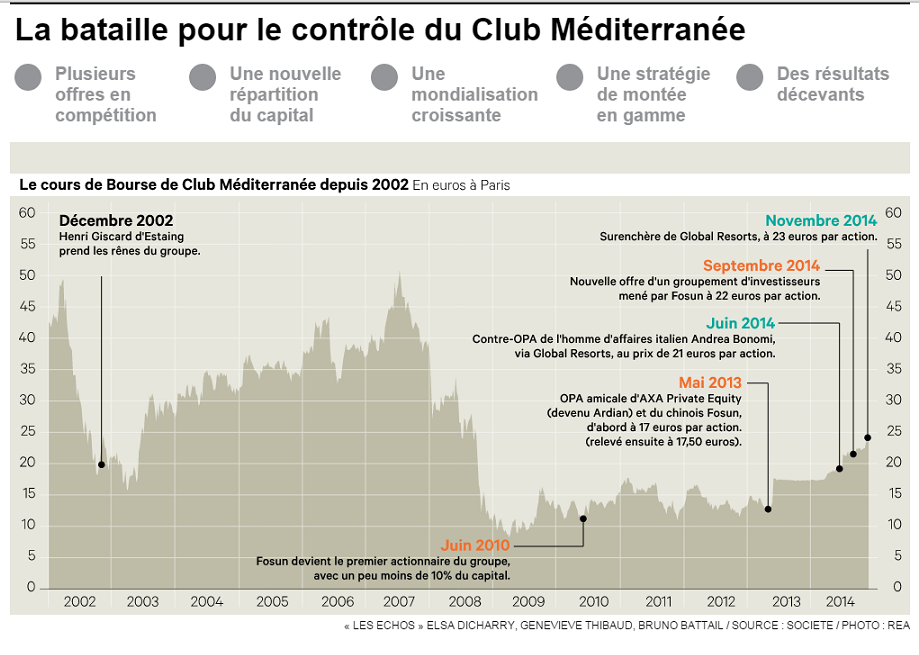

Fosun, through its vehicle Gallion Invest II. is now bidding at 23,50 euro per share while Investindustrial’s bid, through Global Resorts, stands at 23 euros. Bonomi has now until 1700 GMT on Dec. 17 to make a counter-offer.

Fosun’s outbid was just slightly higher than the minimum price asked by the French law (a price 2% higher than the previous bid) the French Supervisory Authority on Financial Markets (AMF) asked.

At the moment Gallion Invest’s shareholders are Fosun, the French private equity fund Ardian (6.2%), Club Med’s top management (3.1%) and the Chines tour operator U-Tour (9.4%), while Brazilian tycoon Nelson Tanure, chairman and ceo of Docas Investimentos, is expected to acquire a maximum 20% stake in line with a statement Gallion made last September when Fosun launched its previous bid at 22 euro per share (see a previous post by BeBeez).

Gallion Invest II and Portoguese insurance company Fidelidade own now a 18.4% stake of Club Med’s capital while Bonomi, through Strategic Holdings (an invesment vehicle controlled by BI-Invest, the holding company of the Bonomi family, which is an ally to Global Resorts in the deal) is the major shareholder with a 18.9% stake.

French Supervisory Authority on Financial Markjets (AMF) established yesterday December 17 as a new deadline for potential counter-bids to be presented (download here AMF’s statement). AMF used again a specific article (art. 232-12) of its General Regulation in order to shorten times in France’s longest-running takeover battle (for a detailed history of Club Med see this dossier by Les Echos).

Bonomi too will have choose a minimum 2% higher price for his bid with respect to the previous bid which is close to 24 euro. However if Bonomi will decide to outbid again Fosun’s offert word is that the AMF might decide to ask both the bidders to present their last offer in a closed envelope so that there will be just one final winner in the race.

Meanwhile yesterday Club Med’s shares in Paris closed at 23.90 euro, the same price of Friday Novembre 28.