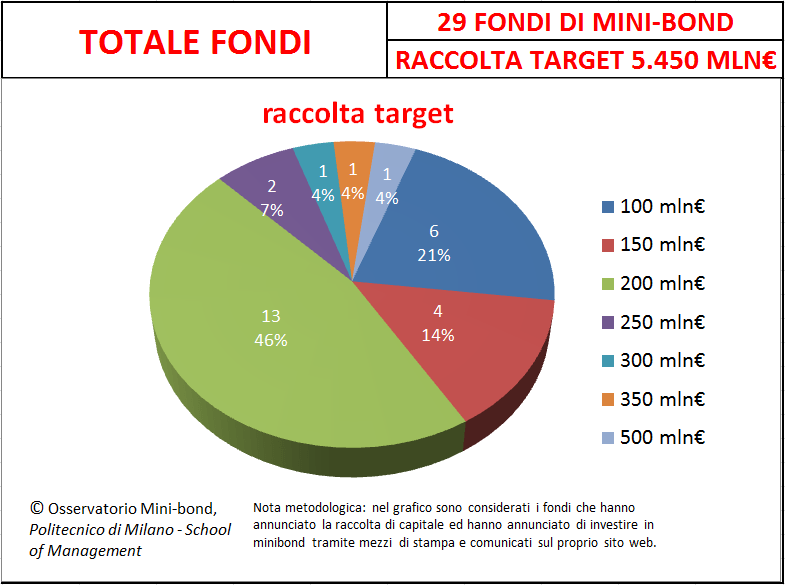

“Politecnico University of Milan’s Osservatorio minibond (i.e. Observatory on SMEs bond issues) calculated that at the end of last September 29 investment funds targeting socalled minibonds have been launched and this number has now grown to 31″, Giancarlo Giudici, corporate finance professor at Milan’s Politecnico said yesterday at a conference on SMEs and minibonds organized in Milan by Cerved spa, the leading Italian business credit data provider.

“Politecnico University of Milan’s Osservatorio minibond (i.e. Observatory on SMEs bond issues) calculated that at the end of last September 29 investment funds targeting socalled minibonds have been launched and this number has now grown to 31″, Giancarlo Giudici, corporate finance professor at Milan’s Politecnico said yesterday at a conference on SMEs and minibonds organized in Milan by Cerved spa, the leading Italian business credit data provider.

“These funds are targeting a total capital rasiing of 5.45 billion euros on the market, including the total fundraising of the fund of funds launched by Italian Government sponsored Fondo Italiano d’Investimento“, Giudici added.

“Italian funds focused on minibonds raised 700 million euros already, including 250 millions from Cassa Depositi e Prestiti to Fondo Italiano d’Investimento”, Aifi‘s managing director Anna Gervasoni said in her speech at Cerved’s conference.

Born as the Italian Private Equity and Venture Capital Assotiation, Aifi has been associating private debt funds since the beginning of this year. On October 10th, Aifi calculated that funds targeting Italian SMEs debt were 30: 20 of them have been launched by independent operators while the remaining 10 have been launched by banks. Among those funds, 17 (13 of them are Aifi’s associates) are already active or almost ready to invest” (download here Aifi’s brochure on private debt funds).