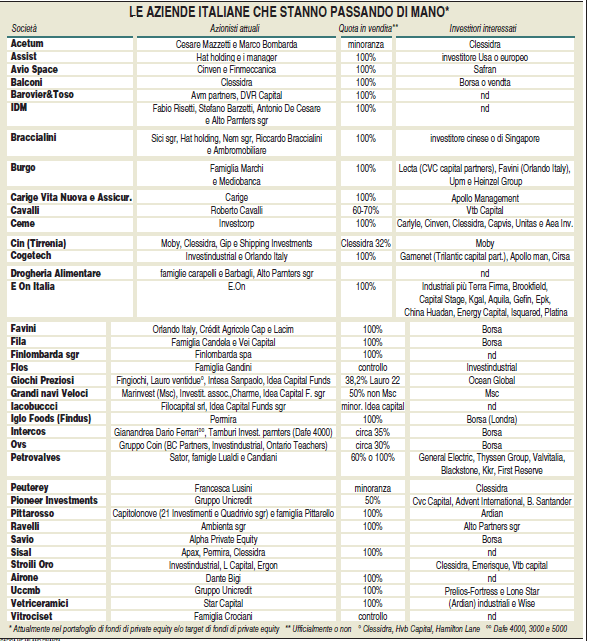

At least thirty deals are on their way for investment bankers and private equity operators in Italy coming back from Summer holidays. This is a figure emerging from a survey by MF-Milano Finanza published last Semptember 13, which is not obviously comprehensive of all the deals these people are working on.

At least thirty deals are on their way for investment bankers and private equity operators in Italy coming back from Summer holidays. This is a figure emerging from a survey by MF-Milano Finanza published last Semptember 13, which is not obviously comprehensive of all the deals these people are working on.

Actually portfolios of private equity funds have still many stakes in Italian companies bought more than 6-7 years ago (see a previous post by BeBeez) which are going to be put on the market as soon as possibile. Moreover more and more Italian entrepreneurs are positive about opening the capital of their company to a financial investors in order to give a boost to the international growth of his business. In some cases however private equity funds are now finding new competitors coming from the private debt sector as small and medium enterpises often think of the two kind of operators are an alternative.

Big operators seems to have more options at the moment, especially Clessidra, Investindustrial or paneuropean funds such as CVC Capital Parnters.