«A couple of years at least will be necessary in order to build a transparent market for small and medium enterprises’ bond issues (i.e. minibonds) which in turn will be able to create a consistent yield curve”, Epis sim‘s ceo Andrea Crovetto told MF-Milano Finanza last Saturday August 2nd.

Founded by former Italian well-known banker Crovetto and other partners, Epic sim is the first platform allowing qualified investors (through bonds or equity) to fund the growth projects of Italian small and medium-sized enterprises. By signing up, companies find a new, qualified funding channel and investors can analyze investment opportunities supported by a social platform allowing open and transparent discussion of each possible transaction.

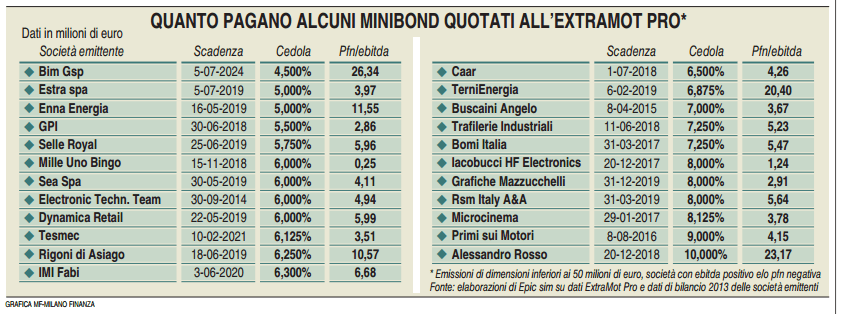

“On average a minibond issued by a BB rated company pays a 5.5%-6% coupon, but data are still too few to be a significant sample and are influenced by the fact that coupons are decided between the issuer and few subscribers of the minibond. The result is that some coupons seem too low with respect to the issuer’s net financial debt while other coupons seem too high”.

Epic started a quarterly report monitoring yield-to-risk relationships for each minibond listed on the ExtraMot Pro market managed by Borsa Italiana (see the table in this page). The report shows that utilities pay lower coupons, while issuers from the financial, game and construction sectors pay higher coupons.

Meanwhile in the last month more and more new issues have reached ExtraMot Pro. The last one arrived today from Global System International (GSI spa), a company that produces parts, made of composite materials, for the body of earth moving machines, trucks and passenger cars (download here the press release by Borsa Italiana and the press release by GSI). The minibond matures in November 2019, pays a 6.75% coupon and is rated B1.1 by Cerved Rating Agency.

On July 31st was listed a 3 million euros minibond by MPG Manifattura Plastica spa, a company producing plastic packaging for food&beverage sector with well-know clients such as Motta (Coppa del Nonno, La Cremeria), Algida (Carte d’Or) and Plasmon (download here the press release by Borsa Italiana). Bonds have an amortizing structur, mature in July 2019 and pay a floating coupon (3m euribor plus 400 basis points).

Last July 29th it was the turn of 8 new minibond issues from local utilities of Italian Region of Veneto to be listed on the ExtraMot Pro. More in detail the minibonds were issued by Acque del Basso Livenza spa (download here the press release by Borsa Italiana), Acque del Chiampo spa (download here the press release by Borsa Italiana), Acque Vicentine spa (download here the press release by Borsa Italiana), Alto Vicentino Servizi spa (sdownload here the press release by Borsa Italiana ), Azienda Servizi Integrati spa (download here the press release by Borsa Italiana), BIM Gestione Servizi Pubblici spa (download here the press release by Borsa Italiana), Centro Veneto Servizi spa (download here the press release by Borsa Italiana ) ed ETRA spa (download here the press release by Borsa Italiana). All the bonds have been issued to finance a stake in a same new infrastructure project in the hydric sector. They all have an amortizing structure, mature in July 2034 and pay a 4.2% coupon.

On July 28th a 50 million euros minibond issue by Trevi Finanziaria Industriale spa was listed on ExtraMot Pro. That happened just few days before a 101 million euros of equity investment was announced by Fondo Strategico Italiano for a minority stake in the company which is a world’s leading group in the field of ground engineering (see a previous post of BeBeez). The bonds pay a 5.25% annual coupon, have maturity Jully 2019 and have been rated A2.1 by Cerved Group Rating Agency (download here the press release by Borsa Italiana, the Minibond presentation to analysts and the Admission document of the bond ).

On July 21 st a 15 million euros minibond was listed by Coswell spa, a company producing healthcare and cosmetic products owned by the Gualandi family ( download here the press release by Borsa Italiana). Coswell owns well-known brands such as Bionsen, Istituto Erboristico L’Angelica,BlanX, BioRepair, Prep, Transvital and produces perfumes for Byblos, Luciano Soprani,Renato Balestra, Rockford, Patrichs. The minibond matures in July 2019, pays a 6.8% coupon and is rated B1.1 by Cerved.